In the world of personal development and financial success, Robin Sharma stands as a towering figure, especially with his transformative book, The 5 AM Club. This seminal work isn’t just a guide to early rising; it’s a blueprint for enriching your life and securing financial independence. For anyone committed to building long-term wealth, adopting Sharma’s principles could be your first step toward financial freedom.

Delving into The 5 AM Club, we uncover how the core teachings of Robin Sharma can guide you on a path to sustained wealth creation. Harness the quiet morning hours for strategic financial planning and embed habits that foster significant economic growth. Robin Sharma’s method provides a structured approach to financial well-being, resonating with both novices and seasoned investors.

Explore key areas where Sharma’s advice intersects with sound financial practices:

- Morning Analysis: Utilize the calm of dawn to assess and strategize your investment moves.

- The 20/20/20 Financial Routine: Tailor Sharma’s morning formula to enhance your financial acumen.

- Mindfulness and Decision Making: Sharma’s emphasis on mindfulness leads to better financial decisions by reducing emotional investing.

Robin Sharma’s disciplined wake-up rituals in The 5 AM Club are not merely about rising early; they are about awakening to new financial possibilities and harnessing the full potential of your morning hours for wealth creation.

Harness the Morning Calm for Strategic Financial Planning

“Take excellent care of the front end of your day, and the rest of your day will pretty much take care of itself. Own your morning. Elevate your life.” – Robin Sharma

Application: This quote emphasizes the power of a disciplined start to your day. Begin each morning with a review of your financial goals and the progress you’ve made towards them. This can include checking your investment portfolio, reviewing upcoming bills, or setting financial tasks for the day. By prioritizing these activities first thing in the morning, you ensure they receive your undivided attention and set a proactive tone that carries through the rest of your day.

Utilizing the serenity of the early morning, as advocated by Robin Sharma, can transform your approach to financial management. This time is ideal for an in-depth analysis of your financial landscape. Begin by examining the performance of your investments against your long-term financial goals. Analyze asset allocations, checking if they align with your risk tolerance and investment horizon. Use tools like financial news aggregators, investment tracking software, and economic trend reports to gather data that could influence your financial decisions.

Further, expand this routine to include monitoring global financial markets, especially if you have international investments. Understanding geopolitical events, currency fluctuations, and international economic indicators can provide you with a competitive edge in managing your portfolio effectively.

Also, consider using this quiet time for scenario planning. Develop strategies for different market conditions—bullish trends, bearish downturns, or volatile swings. Planning for various scenarios prepares you for reacting calmly and effectively, regardless of market conditions.

Incorporate technology to streamline this morning financial review. Use financial apps and dashboards that integrate real-time data and provide analytical insights at a glance. This tech integration not only saves time but also enhances the accuracy of your financial monitoring and decision-making processes.

Implement the 20/20/20 Financial Routine

“The smallest of implementations is always worth more than the grandest of intentions.” – Robin Sharma.

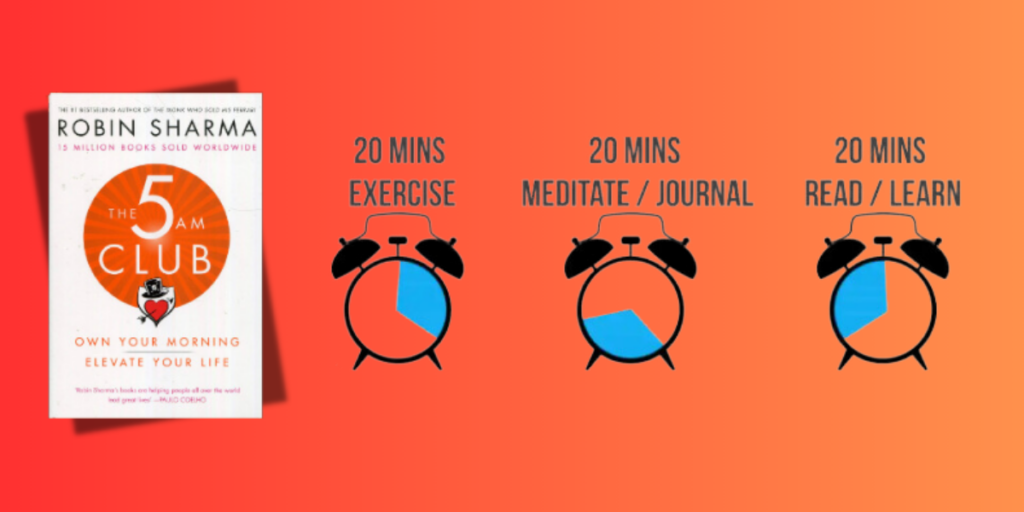

Application: This advice highlights the importance of actionable steps over mere plans. In your morning financial routine, spend the first 20 minutes reviewing and adjusting your budget based on recent spending and saving patterns. Then, use the next 20 minutes to educate yourself about new financial tools or investment opportunities. The last 20 minutes can be dedicated to setting clear, achievable financial tasks for the day. This systematic approach ensures that your good intentions lead to tangible results.

First 20 Minutes – Energize Your Body and Mind through Physical Activity: Kickstart your day with an invigorating exercise session that does more than just wake you up—it catalyzes your cognitive functions and primes your brain for high-level thinking. Choose activities like jogging, cycling, or even a high-intensity interval training (HIIT) session. These are not merely workouts; they are your first steps towards a sharper, more focused mindset essential for navigating the complexities of financial markets. The increased blood flow and oxygen to your brain post-exercise enhance clarity and analytical capacity, making the subsequent financial planning and analysis phases markedly more effective.

Next 20 Minutes – Strategic Financial Planning: Organizing Your Economic Universe: After energizing your body and mind, shift your focus to strategizing your financial day with precision and insight. Start by reviewing any overnight changes in the financial markets and assess their potential impact on your investments and financial plans. Create a prioritized task list that aligns with your long-term financial goals—this may include adjusting your investment positions based on market movements, scheduling meetings with financial advisors, or preparing for upcoming financial commitments. Use digital tools and apps designed for financial management to track your tasks and calendar events, ensuring nothing important slips through the cracks. This meticulous approach to planning not only keeps you aligned with your financial objectives but also enhances your efficiency and effectiveness in managing personal finances.

Final 20 Minutes – Expanding Financial Horizons through Continuous Learning: Dedicate the last segment of your morning routine to education and intellectual growth in the realm of finance. This period should be about expanding your financial acumen and staying abreast of new trends and strategies. Engage with a curated selection of financial newsletters that offer insights into market trends, investment tips, and economic forecasts. Consider enrolling in specialized online courses that focus on areas like cryptocurrency, stock market analysis, or real estate investment to deepen your expertise and diversify your investment skills. Alternatively, participate in live webinars where you can interact with financial experts and like-minded investors, which can provide fresh perspectives and networking opportunities. This commitment to lifelong learning is crucial for maintaining a competitive edge in the fast-paced world of finance and ensures you are always prepared to make informed, strategic investment decisions.

By following Robin Sharma’s 20/20/20 formula with these enhanced, practical steps each morning, you set a powerful routine that not only optimizes your physical and mental health but also fortifies your financial well-being. This holistic approach to starting your day ensures you are always at the peak of your capabilities, ready to tackle the financial challenges ahead with vigor and wisdom.

Cultivating Clarity and Precision in Financial Endeavors

“A bad day for the ego is a good day for the soul.” – Robin Sharma

Application: Incorporate this wisdom by starting your mornings with a few minutes of reflection on your recent financial decisions. Assess what you could have done better and acknowledge your successes without arrogance. This practice of humility and continuous learning will refine your decision-making process and align your financial strategies more closely with your long-term objectives.

Initiating the Day with Mindful Meditation: Aligning Vision with Financial Aspirations Start each morning by establishing a sanctuary of stillness through meditation, a pivotal practice in honing your focus and aligning your mindset with your financial goals. This isn’t just about calming the mind; it’s about programming it for success. As you meditate, engage in a visualization exercise where you picture achieving your financial targets—imagine the satisfaction of reaching your investment milestones or the peace that comes with financial stability. This process not only sets a positive tone for the day but also subtly steers your subconscious toward making choices that propel you toward those envisioned successes. Extend this practice by incorporating affirmations specific to your financial aspirations, reinforcing your commitment and enhancing your mental readiness to tackle the day’s financial challenges.

Enhancing Emotional Regulation Through Targeted Mindfulness Techniques To effectively navigate the often turbulent waters of financial markets, integrating mindfulness exercises into your morning routine is crucial. These practices should specifically focus on emotional regulation, a key component in maintaining decision-making composure under pressure. Techniques such as mindful breathing, where you consciously regulate and extend your breath, can help mitigate the stress associated with market volatility. Additionally, engage in guided imagery exercises where you visualize maintaining calm and making informed decisions even in chaotic market scenarios. This training helps condition your mind to remain focused and undisturbed by sudden market movements, enabling you to make decisions that are grounded in rational analysis rather than impulsive reactions.

Journaling for Enhanced Financial Insight and Accountability One of the most effective ways to deepen your mindfulness practice and its impact on financial decision-making is through journaling. This should be a detailed daily practice where you not only record your financial decisions and their outcomes but also delve into the reasoning behind each decision and the emotions that influenced it. Such reflective writing can unveil patterns in your decision-making, highlight areas influenced by emotional bias, and reinforce strategies that led to successful outcomes. Make this practice interactive by reviewing past entries regularly, assessing decisions in hindsight, and adjusting your strategies as needed. This ongoing dialogue with yourself not only fosters greater self-awareness but also enhances your ability to approach financial decisions with clarity and strategic foresight.

Building a Routine of Reflective Practice to Master Financial Decisions To truly benefit from the mindfulness practices you incorporate, consistency is key. Make these techniques—meditation, targeted exercises for emotional regulation, and journaling—an integral part of your daily routine. Over time, this consistent practice will not just improve your ability to handle financial stress but will also refine your overall approach to personal finance management. The routine you establish will become a foundational pillar of your financial strategy, ensuring that every decision is approached with a clear mind and a focused intent, ultimately leading to smarter, more sustainable financial outcomes.

By integrating these mindfulness practices into your daily routine, you not only enhance your immediate decision-making abilities but also set the stage for long-term financial success and stability. This holistic approach to financial mindfulness ensures that every day begins with a clear purpose and a strategic framework, guiding you towards achieving and surpassing your financial goals.

Laying the Foundation for Financial Mastery

“Remember, every professional was once an amateur, and every master started as a beginner.” – Robin Sharma.

Application: Use your morning time to build your financial expertise gradually. Dedicate time to read financial news, watch tutorial videos, or listen to podcasts that enhance your understanding of the markets and different financial instruments. Consistent, dedicated learning during these undistracted morning hours will compound over time, turning you from an amateur into a seasoned investor.

Establishing a Robust Morning Financial Ritual Embrace the transformative power of a consistent morning routine, as championed by Robin Sharma, to navigate your financial landscape with precision and insight. A robust morning ritual is more than a habit; it’s a strategy that sets the tone for your financial success each day. Begin by dedicating time each morning to a thorough review of your financial status. This could involve checking the latest stock market updates, reviewing your investment portfolio’s performance, and assessing any significant overnight changes that could impact your financial strategy. Utilize advanced financial tools and apps that provide real-time data and analytics to keep your finger on the pulse of the financial world, ensuring you start your day with a comprehensive overview of where you stand and where you need to focus your efforts.

Deepening Financial Engagement Through Daily Reviews Make your morning review a cornerstone of your day, where each session builds upon the last. This structured approach is not merely about staying informed but about actively engaging with your finances in a way that promotes continuous improvement and learning. For example, take the time to analyze trends in your investment performance over time, identify new opportunities for diversification, or reconsider asset allocations based on current market conditions. By making this review a daily practice, you embed these tasks into your subconscious, enhancing your financial acumen and intuition over time.

Setting and Achieving Mini-Goals for Daily Financial Growth Incorporate the setting of daily mini-goals into your morning financial ritual to maintain momentum and foster a culture of continuous improvement. These goals could range from optimizing your budget, exploring new investment platforms, or even committing to learning a new financial concept each day. For instance, set a goal to read one financial article or watch one tutorial video daily to expand your understanding of market dynamics or financial instruments. By achieving these mini-goals, you not only gain a sense of accomplishment but also incrementally enhance your financial skills and knowledge, paving the way for long-term success.

Automating Good Financial Habits for Long-Term Success As you cultivate these morning rituals, focus on automating good financial habits that support your long-term objectives. This could involve setting up automated investments into your retirement accounts, scheduling regular transfers to your savings, or using financial planning software to forecast future financial scenarios based on your current data. Automation acts as a force multiplier in your financial strategy, ensuring that you consistently contribute to your financial goals without having to make a daily decision to do so.

Reflecting on Progress to Reinforce Success End each morning session with a brief reflection on the progress made towards your financial goals. This reflection should be both a review of the day’s achievements and a preparation for future actions. Maintain a financial journal or dashboard where you can visually track your progress against your goals, making adjustments as necessary. This practice not only keeps your goals in sharp focus but also reinforces the benefits of your morning routine, encouraging you to stick with it even when progress seems slow.

By meticulously implementing these enhanced morning rituals based on Robin Sharma’s teachings, you set a powerful daily cadence for your financial life. This routine doesn’t just prepare you for the day—it builds a foundation of disciplined financial management that can sustain long-term wealth growth and stability.

A Path to Prosperity

“All change is hard at first, messy in the middle and gorgeous at the end.” – Robin Sharma.

Application: The journey to mastering your morning routine mirrors the pursuit of financial excellence—both are challenging ventures that require dedication and resilience. As Robin Sharma eloquently states, any transformative process can feel tumultuous at its inception and throughout, but the outcomes are invariably beautiful and rewarding.

Embrace the early struggles and the complexities as they come. The initial discomfort of waking up early and dedicating those first hours to financial planning or personal development will eventually translate into a robust routine that consistently drives success and satisfaction.

By owning your mornings, you not only enhance your daily productivity but also set a proactive tone that permeates your entire life. This disciplined start leads to sharper decision-making, more profound focus, and ultimately, a more fulfilling financial and personal journey.

Let this understanding guide you: the efforts you put in today lay the groundwork for your future prosperity. Stick with it, adjust as necessary, and remember that every day brings you one step closer to the life you aspire to lead.

The path to prosperity is paved with persistence. Start small, dream big, and begin now. Each morning is a new opportunity to edge closer to your goals. With each sunrise, remind yourself of the power of your actions and the potential of your resolve. You are not just planning your day; you are sculpting your destiny.

As we reflect on the transformative strategies discussed, rooted in Robin Sharma’s The 5 AM Club, it becomes evident that a disciplined morning routine is not just a practice but a pathway to profound financial success and personal growth. By starting each day with strategic financial planning, engaging in physical and mental exercises, and dedicating time to expand your financial knowledge, you create a foundation of habits that propel you toward your goals. Each component of your morning—be it the analytical assessment of your investments, the physical vigor from your workouts, or the intellectual growth from your studies—contributes uniquely to building a holistic and resilient financial persona.

Moreover, the mindfulness practices and daily goal-setting we’ve explored serve as crucial tools in cultivating a mindset that is both reflective and forward-thinking. These practices not only enhance your ability to make informed decisions amidst market volatilities but also embed a proactive approach to personal and financial well-being. They transform morning routines from mundane tasks to powerful sessions of self-improvement and strategic planning, each day adding a layer of expertise and confidence to your financial journey.

In conclusion, let this exploration serve as a catalyst for you to reimagine your mornings. Embrace these practices with consistency and intention, and observe how they not only transform your financial outlook but also enrich your life.

Set your alarm, rise with purpose, and greet each dawn as an opportunity to advance toward your goals with renewed vigor and clarity.

Start tomorrow by picking one new element to add to your morning routine, whether it’s a brief meditation focused on your financial aspirations or a review of your investment strategies. As you build these habits, you will find that each morning brings you closer to the financial mastery and life success that you envision.

Ready to take the next step in your wealth creation journey?

Explore our Six Pillars of Wealth and discover how to integrate these principles into your overall wealth-building strategy.

Don’t forget to check out our other insightful articles on effective financial education, positive mindset training, plus the benefits of having a money mentor to continue enhancing your financial knowledge.